About Andelise Lunara

Andelise Lunara, MBA, CFP®, CLU®, ChFC®, LUTCF®, PPC™

INVESTMENT PORTFOLIO MANAGER & CERTIFIED FINANCIAL PLANNER™

Education

- Master of Business Administration (MBA) from Cornell University

- Degree with Distinction earned for being in the top 10% of class

- Master of Business Administration (MBA) from Queen’s University

- Certificate in FinTech from Cornell University

- Bachelor of Science in Business Administration from University of Hartford

- Magna Cum Laude graduate with Major in Economics and Finance, and Minor in Sociology.

- Beta Gamma Sigma member, which is an honor society for the best students in accredited business programs

- Recipient of the Senior Book Award, given to the top senior in the Business School.

Community & Charity Involvement

- Andelise Lunara was the youngest person to ever get elected to the Worcester City Council at age 24

- Served 3 two-year terms representing District 1 from Jan. 2006 – Jan. 2012

- Appointed by the Governor to the Board of Trustees of the State Library of Massachusetts

- President of the Estate & Business Planning Council of Worcester County

- Elected as a Corporator of the Worcester Art Museum

- Co-Chair of the Worcester Art Museum Business Partner Committee

- Board member of the Downtown Worcester Business Improvement District (BID)

- Organized Andelise Lunara Celebrity Auction charity event, which raised over $50,000 for

- Worcester area charities

- Boxed in the Give Kids a Fighting Chance charity boxing events to benefit the Worcester Boys

and Girls Club - Member of The Worcester Economic Club

- Member of the Financial Services Institute

- Helped organize and host Karaoke for a Cure charity event to benefit cancer research

- Board member of the Masonic Angel Fund charity, which provides financial assistance to children in need at local schools

- Steering Committee member of the Worcester Tree Initiative

- Danced in Salsa with Worcester Stars charity event to benefit Centro Las Americas

- Board member of the Hourglass Foundation

- Served on the Board of Worcester Comprehensive Education & Care, Inc.

- Volunteered to help coach Little League baseball teams

- Volunteered to help with Special Olympics

Honors

- Qualifying member of the Top of the Table of the Million Dollar Round Table, of which less than 1% of financial advisors worldwide qualify.

- Recipient of the prestigious 40 under Forty award by the Worcester Business Journal.*

- Selected as one of the Top 25 To Watch by Pulse Magazine.*

- Played Division 1 baseball at the University of Hartford.

*40 under Forty honorees nominated by readers and selected by a Worcester Business Journal panel of judges. Top 25 to Watch honorees selected by Pulse Magazine as examples of diligence, strength and drive that can inspire.

Asset conservation and Estate Management

What you cherish might surpass the significance of your material possessions. To uphold your commitments—whether to yourself, your family, or your principles—you must plan proactively. A tailored estate plan is crucial for safeguarding both your family and your legacy. An expertly crafted strategy can address your distinct estate planning requirements, such as: Reducing income and estate tax liabilities Facilitating the intergenerational transfer of wealth Formulating strategic charitable contributions Harmonizing existing portfolios and retirement accounts with your estate plan.

Strategic Business Continuity Planning

Owning a business entails a unique set of responsibilities. Adapting your current business structure or effecting a successful transition before retirement necessitates meticulous planning. Given the intangible factors such as personal emotions, familial dynamics, and business affiliations, the impartial guidance of a seasoned advisor can greatly facilitate the process. A robust business succession plan can address your specific needs, including: Expanding your enterprise Safeguarding your assets Ensuring the seamless continuation and succession of your business Mitigating tax liabilities Attracting, retaining, and incentivizing key employees Enhancing your compensation packages Achieving estate equalization Fostering family unity.

Strategic Retirement Preparation

The financial requirements for retirement are contingent upon factors such as your planned retirement age, desired lifestyle, anticipated lifespan, and the expected returns on your investments. Given that Social Security and employer-sponsored pension plans are likely to provide less than they did for previous generations, careful planning is essential. To optimize your retirement income, consider employing one or more of the following strategies: Establishing clearly defined retirement goals and objectives Delaying retirement to extend earning years Increasing savings contributions Reducing expenditures during retirement Investing for potentially higher returns while managing acceptable risk levels Liquidating non-cash assets Leveraging Social Security benefits Maximizing contributions to qualified retirement plans Investing in Individual Retirement Accounts (IRAs).

Empowering Education Through Financial Support

Strategic educational planning for your offspring can represent a substantial financial consideration. Initiating this process early enables you to leverage the time value of money and potentially reduce the requisite savings. It is advisable to evaluate one or more of the following methodologies to optimize your collegiate funding strategy:

Integrate your educational goals with insurance needs, retirement planning, major expenditures, and current income requirements.

Develop a robust savings strategy that incorporates asset allocation and capitalizes on educational investment plans.

Explore various educational funding accounts, such as Qualified State Tuition Plans (529 Plans), Uniform Transfer to Minors Accounts (UTMAs)/Uniform Gifts to Minors Accounts (UGMAs), Coverdell Education Savings Accounts, and prepaid tuition plans.

Ensure comprehensive planning for college expenses, including tuition, room and board, and living costs. Account for inflation to anticipate rising educational costs. Additionally, evaluate the necessity of planning for postgraduate studies and the potential for scholarships or financial aid.

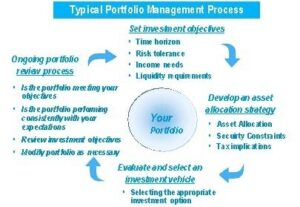

Dynamic Investment Portfolio Administration

You can now access portfolio management services comparable to those used by institutional investors, whether through separately managed accounts or mutual fund wrap portfolios. Benefits of managed portfolios include:

Access to top-tier investment management professionals

Custom-tailored portfolios designed to meet specific investment objectives

Ownership of individual securities

Convenience of pre-constructed mutual fund portfolios

Investment advisory services cater to the uniqueness of each investor by providing professional guidance and a personalized investment strategy. Whether you seek a bespoke, professionally managed portfolio or the simplicity of a diversified mutual fund wrap, your investment approach should align with your financial goals. In this process, consider your current and future growth objectives, income requirements, time horizon, and risk tolerance. These factors will guide the development of your portfolio management strategy. The process encompasses, but is not limited to, the following key stages.

Define investment objectives

Formulate an asset allocation strategy

Select appropriate investment vehicles

Conduct regular portfolio reviews and ongoing monitoring.

Strategic Risk Mitigation

A comprehensive plan must address the insurance needs of you, your spouse, and family members:

Life Insurance: Covers funeral expenses, outstanding debts, charitable donations, and living expenses for surviving family members. It can also address estate taxes and probate fees, facilitating the proper liquidation of your estate.

Disability Income Insurance: Partially replaces income for individuals unable to work due to illness or injury. Long-term disability can have financial impacts comparable to death, making it crucial to have protection from social insurance programs, employer benefits, or individually purchased policies.

Long-Term Care Insurance: A relatively new insurance product, often misunderstood in terms of coverage, benefits, and suitability. It’s essential to understand what this insurance covers and how it can be advantageous.

SEE ALSO

My Mission

To partner with clients in long-term, trusted relationships, always putting their best interests above my own.

Investment Solutions

Part of the investment planning process is selecting investments that fit within your asset allocation strategy and working together to help you accomplish your investment goals.

My Services

I understand that each investor has unique goals, preferences, and risk tolerances. That’s why we believe in customized investment portfolios tailored to your specific needs.

Investment Tenets

All great traders determine what they are willing to lose before they think about what they will earn on a trade. Decide before you enter a trade where you will exit.